THIS IS LIKE A BANA REPUBLIC LAWLESSNESS

Summary

- Johnson-Crapo is dead on arrival.

- Yale Law School scholar sides with shareholders.

- Injunctive relief more likely as Treasury causes irreparable harm.

The good news for Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) shareholders arrived this morning; the Johnson-Crapo Bill would not be marked up and not go through the process of counting votes for or against. This was the last opportunity to get the bill out of the Senate Banking Committee in 2014, before the election cycle begins.

This means that there is no meaningful legislation that will be passed in the next few months out of either the House or Senate. The most pertinent news driving the stocks will be each company's earnings and the outcome of discovery in several of the lawsuits against the government, filed by shareholders.

FNMA data by YCharts

Yale Law School Scholars Side with Shareholders

On April 27, 2014, Jonathan R. Macey and Logan Beirne of Yale Law School published a paper titled "STEALING FANNIE AND FREDDIE." Here is the summary of this paper and link to the text.

Politicians are running rough-shod over the rule of law as they seek to rob private citizens of their assets to achieve their own amorphous political objectives. If we were speaking of some banana republic, this would be par for the course - but this is unfolding in the United States today.The housing market accounts for nearly 20 percent of the American economy, so it is critical that we have a strong and stable housing finance system that is built to last," declares the Senate Banking Committee Leaders' Bipartisan Housing Finance Reform Draft. The proposed legislation's first step towards this laudable goal, however, is to liquidate the government-sponsored enterprises Fannie Mae and Freddie Mac - in defiance of the rule of law. This paper analyzes the current House and Senate housing finance reform proposals and faults their modes of liquidation for departing from legal norms, thereby harming investors and creditors, taxpayers, and the broader economy.Under proposals before Congress, virtually everyone loses. First, FannieMae and Freddie Mac's shareholders' property rights are violated. Second, taxpayers face the potential burden of Fannie Mae and FreddieMac's trillions in liabilities without dispensing via the orderly and known processes of a traditional bankruptcy proceeding or keeping the debts segregated as the now-profitable Fannie Mae and Freddie Mac seek to pay them down. Finally, the rule of law is subverted, thereby making lending and business in general a riskier proposition when the country and global economy are left to the political whims of the federal government.

On a brief media call, Professor Macey answered questions and gave additional information regarding the Conservatorship, the Johnson-Crapo Bill, and the shareholder lawsuits.

As noted by Professor Macey, both entities were reportedly solvent on the date that they were placed into Conservatorship. They were both private for-profit companies whose shares were traded publicly on the stock exchanges. The Conservatorship agreement opened up a borrowing line of senior preferred stock at a cost of 10% and in return for that support, thegovernment forced the companies to issue warrants for 79.9% of the common stock at a minimal cost.

Subsequently, FHFA and Treasury revised the original agreement several times by delisting the shares and changing the dividend cost from 10% to 100% of net worth (known as the 3rd Amendment to the PSPA).

Macey added that the government had a conflict of interest as an investor, with self-interest, and their fiduciary obligations as regulator to treat shareholders with an even hand. In clear violation, the government amended their stock agreement and forced the net worth to be wiped out and all future earnings to be swept to the Treasury. Clearly, this violates their fiduciary duty to shareholders. Mr. Macey finds the exclusion of shareholders troubling.

Proposed legislation in Congress would repeal the entities' charters and liquidate the entities, which would codify the illegal actions of Treasury. Mr. Macey believes that failure to pay attention to the rights of shareholders would not go unnoticed and future transactions with the government couldbe impaired by this precedent.

Abiding by the rule of law is what makes the United States economyattractive to domestic and foreign investment. Trampling on the rule of law has broad impacts for all companies in the United States economy.

Injunctive relief becomes more likely as the government continues their wind-down and liquidation plans, as the actions move towards causing irreparable harm. In a normal bankruptcy, the trustee is independent of anyof the claimants. This is obviously not the case with Fannie Mae and Freddie Mac. Additionally, in a typical bankruptcy liquidation, the trustee would not set up the liquidation of an entity that is on-going, profitable, and employing people.

Under the Constitution, Congress does not have the power to deprive the courts of their power to rule over a case, subsequently after a case is filed. Having a claim filed in a state court may actually benefit the plaintiffs in that the court is less beholden to the federal government.

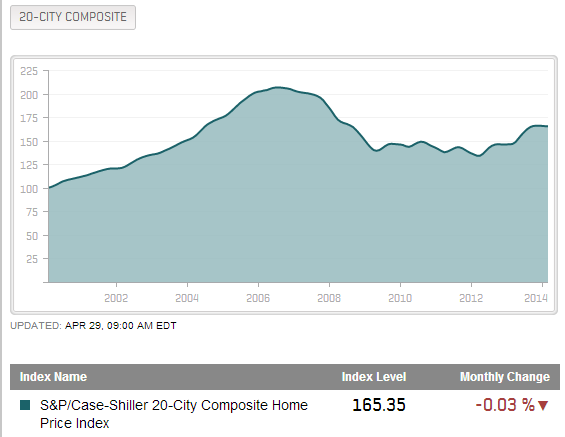

Housing Data Show Recovery, but Long-term Weakness

On Monday, pending home sales were released, showing an increase of 3.4% versus the expectation of 1% for March. Later in the week, the Case Shiller 20-city index showed a 12.9% year over year gain, which was less than the expected 13%. These figures appear to show a healthy housing market.However, the homeownership rate in the United States fell to levels not seen in 19 years. This is an indication that household formation is low and there could be long-term weakness in housing, unless the credit markets are opened up to first time homebuyers.

Conclusion

The United States economy cannot wait on Congressional GSE reform and continuation of the status quo will significantly impair the housing secondary market. This could trigger injunctive relief by the courts. Therefore, an equity restructuring of Fannie Mae and Freddie Mac is imminent.

UPDATE YOUR ALERT SUBSCRIPTIONS NOW:

| Symbol | Alerts | Price | Chg | % Chg | |

|---|---|---|---|---|---|

| BAC |

Bank of America Corporation

| 15.24 | +0.29 | +1.94 | |

| C |

Citigroup Inc.

| 48.16 | +0.86 | +1.82 | |

| FB |

Facebook

| 58.15 | +2.01 | +3.58 | |

| FNMA |

Fannie Mae

| 3.92 | +0.12 | +3.16 | |

| TWX |

Time Warner Inc.

| 64.74 | -0.34 | -0.52 |

About this article

Emailed to: and 399,328 people who get Macro View daily.

Problem with this article? . Disagree with this article? Submit your own.

More articles by David Sims »

- Thu, Apr 24

- Senate Staffers 'Do The Hustle' With Fannie And Freddie ShareholdersFri, Apr 11

- Wed, Apr 9

- Thu, Apr 3

Comments (14)

Track new comments

-

Simple Steps to Grow Fannie Mae and Freddie for the next 20 years.

Prosecute Franklin Raines, Daniel Mudd and their cronies in public trials to make sure the future management think harder before commiting any crimes. Nobody is above the law, include Congress.

Ban 10 years for any financial institutions who commit frauds. Prosecute banks, lenders and financial institutions to full extend of the law. Make sure the crooks hurt badly with huge fine so they never do it again.

Fire Senate Banking Committee Chairman Tim Johnson, a South Dakota Democrat, Republican Senator Mike Crapo of Idaho, Shaun Donovan, secretary of the Department of Housing and Urban Development, National Association of Realtors, Senator Bob Corker, a Tennessee Republican. Make sure these impotent politicians never serve again.

The Federal Housing Finance Agency continues to monitor and regulate both Fannie Mae and Freddie Mac to make sure both incompetent politicans, parasitic lobbiest, and big banks never mess around again.

Less interferences from government with their reckless policy. Draw a simple line and keep it that way.

New professional management and investors with integrity at Fannie Mae and Freddie Mac will propose restructures and continue its path to serve America for century ahead.

Continue to pay to US Treasury and Taxpayers its shares and attract more investors.

America will be happy again with stability and prepare for prosperity. -

Fannie Mae and Freddie Mac has served Americans so well since its inception. Not enough prosecution, only slapping on the wrist. There were bigger crooks behind Fannie Mae and Freddie Mac, same crooks brought America down to its knee and destroyed million lives around the world and outside America in return with their reckless policies and toxic financial packages. You have had no ideas why the world hating us after the financial crisis in the hands of few powerful politicians in Washington D.C and their financial villains in Wall Street.

Now we are going to make a same mistakes again with impotent politicians and their allies again.

America is a great country and Americans are the most admired people around the world. We have to preserve the integrity and strength of America at all cost.

Vote your heart out and kick the crooks out of Congress and America. -

Fannie Mae and Freddie Mac stocks and value will triple (200% increase) IF we fire the impotent politicians the upcoming election:

FSenate Banking Committee Chairman Tim Johnson, a South Dakota Democrat, Republican Senator Mike Crapo of Idaho, Shaun Donovan, secretary of the Department of Housing and Urban Development, National Association of Realtors, Senator Bob Corker, a Tennessee Republican. Make sure these impotent politicians never serve again.Fannie Mae and Freddie Mac stocks and value will double (100% increase) IF: we replace the current management.The world will rejoice. -

It just seems to me, that the further we get into discovery, the more that FHFA and treasury officials would want a settlement. UNLESS, the current leadership is intent on seeing their predecessors prosecuted for their unscrupulous roles in this hijacking. It may be that a few of these "leaders" have some skid marks in their drawers!!!

Comments

Post a Comment