There's A Zucker Born Every Minute

Summary

- Facebook shares have taken a beating as of late along with a majority of the rest of the high flying momentum cohort.

- Facebook may be the instrument of its own destruction by using stock rather than cash to acquire other companies.

- According to a recent report Facebook’s active users have dropped just as the company moved into heavy monetization mode.

- I submit the recent spending spree combined with a significant ratcheting up of monetization and insider selling signals the beginning of the end for Facebook.

"There's a Zucker born every minute"

The above phrase is a play on the timeless maxim "There's a sucker born every minute." The maxim is often credited to P.T. Barnum but was most likely spoken by David Hannum in condemnation of P.T. Barnum and his customers. It means "Many people are gullible, and we can expect this to continue." I believe this maxim apropos in regards to the goings on with Facebook (FB) currently. Based on a series of recent developments I submit Facebook may be nearing the end of its life cycle rather than the beginning as many would have you believe. In the following sections I will lay out my bear case for the stock.

Facebook may be the instrument of its own destruction

Facebook has been on a major spending spree as of late. Facebook has bought up all kinds of bizarre companies from drones to virtual reality which would seem to have little or no discernible relevance to the company's current bottom line. On February 19th, Facebook bought fast-growing mobile-messaging startup WhatsApp for $19 billion. The company used mostly cash and some stock. At first the report of the acquisition was heralded as great news for the technology market due to the fact the value of other like-technology companies rose in comparison.

(Chart provided by Finviz.com)

Nonetheless, when details of the deal were released, regarding the fact Facebook used mostly stock rather than cash for the purchase, this effectively burst the social media bubble sending Facebook and the Powershares (QQQ) plummeting as market participants ran for the exits.

(Chart provided by Finviz.com)

Since that time the market participants have shifted their focus from growth to value stocks, and I submit that is still the case as of today. The high-flying momentum stocks have been severely sold off regardless of the earnings results. It appears market participants are no longer satisfied with ephemeral valuation metrics such as the number of eyeballs and the like. Investors have come to their senses so to speak and are demanding earnings and income, as they should. This cycle happens every so often with the disparity between growth and value stocks widens significantly. I surmise the recent snapback in the stock is more related to short covering than anything else, with much more downside pain to come. Facebook's monetization method of introducing innumerable ads into users' timelines appears to me as if Zuckerberg sees the writing on the wall, and is cashing in while the getting is good. This seems like bad news to me rather than good news.

Facebook and other legacy social sites are experiencing active usage declines

In a new study just out Tuesday by GlobalWebIndex active usage for Facebook slipped 6%. Furthermore, many other popular social networks are experiencing slippage as well. Active usage of YouTube (GOOG, GOOGL) has dropped 8%, LinkedIn (LNKD) is down 3% and Twitter (TWTR) dropped 3% since the third quarter of 2013. On the other hand, Instagram, Tumblr and Pinterest were up 25%, 22%, and 7% respectively. This does not bode well for Facebook's future in my book.

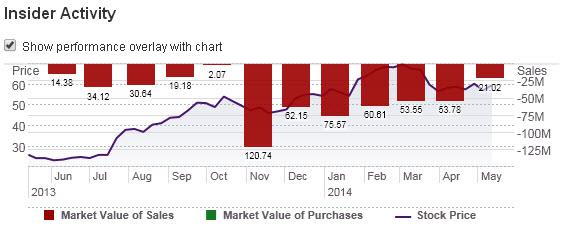

Insiders are bailing out faster than you can say WhatsApp

Insider ownership is down over 40% in the last six months. There has been no insider purchase of Facebook's stock within the last year.

(Chart provided by Scottrade.com)

In fact, there has been only one insider purchase ever, when Reed Hastings purchased 47.8K shares on 8/8/2012. Sheryl Sandberg has divested over half of her overall stake. Her total shares are down to 17.2 million versus about 41 million share at the time of Facebook's IPO in May 2012. Nearly 16 million shares were sold late in 2012 to pay a tax bill due when the restricted stock vested and become ordinary shares.

Conclusion

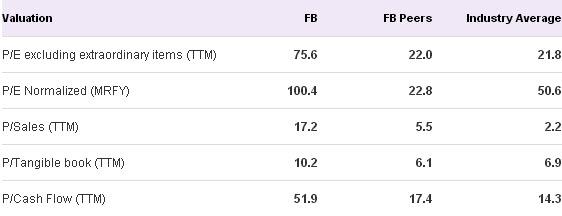

Don't be fooled into thinking you are getting Facebook at a bargain basement price simply because the company's stock is down significantly in recent weeks either.

(Table provided by Scottrade.com)

The stock is trading for 75 times trailing earnings while the industry and peers are trading for closer to 20. Furthermore, with the market in value mode and heading into the summer doldrums, there is no telling how low the stock could go in the coming weeks.

Final Thought

There are too many unanswered questions regarding Facebook's future at this time. It will be interesting to see if Zuckerberg and company can pull this off. As far as I can see the deck is stacked against them. I'm on the sidelines for now. Facebook's stock is a "No Touch" in my book.

Comments

Post a Comment