home prices are up and up- so will be FNMA

- Get link

- X

- Other Apps

Home prices are moving so far, so fast, that at least 1,000 local housing markets have hit all-time price highs, according to Zillow. It should come as no surprise, therefore, that potential home sellers are giddy with value.

"I even hear them say that prices are skyrocketing," said Jeremy Cunningham, a northern Virginia real estate agent with Redfin, a real estate brokerage. "When you ask them what their data source is or where they're getting their information, it's more of a vibe."

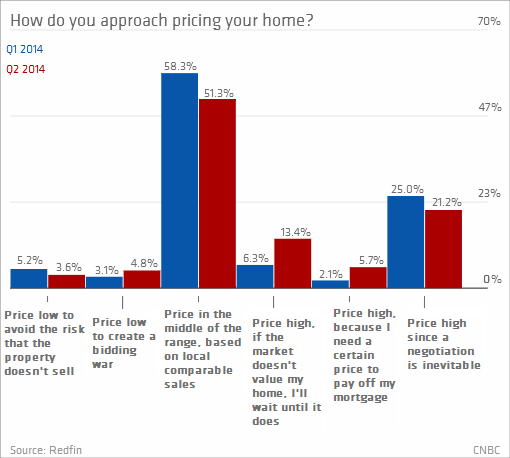

Forty percent of sellers surveyed by Redfin said they are planning on pricing their homes above market value when they list in the second quarter of this year; that's up from 33 percent at the beginning of the year. Redfin polled 1,128 active home sellers across 25 U.S. cities.

Getty Images

A home for sale in Miami.

Confidence is behind it all. Fifty-two percent said they were confident that now is a good time to sell, versus just 37.5 percent three months ago. This, conversely, as sales of existing homes were actually lower in March by 7.5 percent from a year ago, according to the National Association of Realtors.

Another survey of 1,000 homeowners and renters by mortgage giant Fannie Mae found that those who say it is a good time to buy a house held steady in April at 69 percent, but those who say it is a good time to sell increased 4 percentage points from the previous month to 42 percent, an all-time survey high.

"Consistent with (April's) upbeat jobs report, concern about job loss among employed consumers also has hit a record survey low. These results are in line with our expectations for increased housing activity and gradual strengthening of the housing market going into the spring and summer selling season," said Doug Duncan, Fannie Mae's chief economist.

More sellers now say they are pricing their homes high because they are willing to wait if it doesn't sell, according to Redfin. An increasing number of sellers also say they are pricing high because they need that value to pay off their mortgages. Nearly 10 million U.S. homeowners were underwater on their mortgages at the end of last year, according to Zillow.

The Soricelli family in northern Virginia thought about selling their home a year ago, but held off, hoping that prices would improve. After watching solid home appreciation in the neighborhood and across the country, they decided to put their home up for sale this spring. Their asking price, however, was higher than their real estate agent, Cunningham, thought was realistic.

"My wife and myself, we take a lot of pride in our house and did a lot of upgrades," said Brad Soricelli. "We put a lot of money into it, so in trying to reconcile that with what the market is now, there was a little back and forth."

Cunningham said he is usually able to talk his clients back to reality by showing them comparable sales, but the data can be confusing. That is especially true in markets where investors and all-cash buyers are more prevalent.

Sellers are more likely to get their asking price from an all-cash buyer, and all cash means there will be no appraisal issues. However, for those in markets where there are fewer investors and all-cash buyers, commanding an above-market price is a dicey proposition. Even if they do strike a deal with a credit-dependent buyer, they are at the mercy of the appraiser, who will make the final decision as to the real market value of the home.

"When you look at comps, it's very difficult. The trends are hard to identify," said Cunningham. "You could have on any given street, price variations of $50,000 to $75,000 for the exact same house."

The Soricellis did take Cunningham's advice and brought their asking price down. The house sold in one day, but they say they have no regrets.

Read MoreThe boom in $100 million home sales

"Not having to go through waiting and some of the aggravation of having your house on the market for a period of time is worth a certain amount of money," said Brad Soricelli.

Especially when they look across the street. Their neighbor's house, which has already undergone a price drop, is still sitting on the market.

| Mortgages |

| ||||||||||||||||||||||||||||

—By CNBC's Diana Olick.

- Get link

- X

- Other Apps

Comments

Post a Comment