Freddie And Fannie Should Re-List

Summary

- Fannie Mae reported $5.3 billion in income yet pays Treasury $5.7 billion in dividends.

- Freddie Mac reported $4.0 billion in income yet pays Treasury $4.5 billion in dividends.

- Both stocks have traded above $1.00 per share for over a year and should re-list.

- The Federal Housing Finance Authority is failing in their fiduciary responsibility to shareholders if they don not permit re-listing.

- Retail investors need institutional support to free the GSEs from Treasury's vampire-like gripe and allow them to recapitalize and rebuild shareholder value.

Introduction

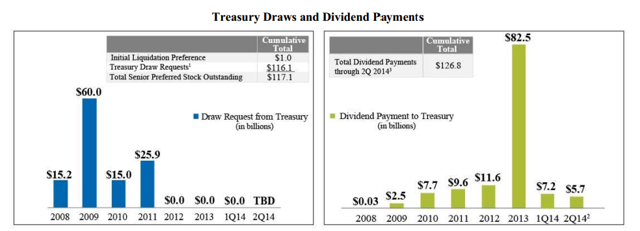

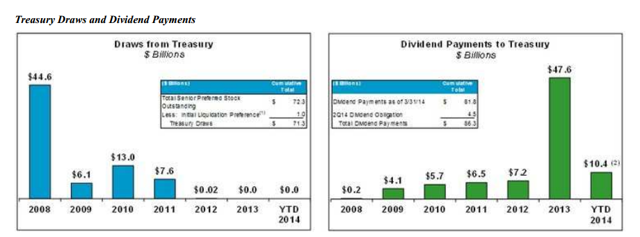

Five years ago, the situation with the GSE's Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) seemed hopeless. Pundits argued about the companies' insolvency. Great minds colluded to try and figure out the best way to wind down and dismantle the mortgage giants without crippling the U.S. housing market even more than what it already was. In total, the U.S. Government invested more than $117 billion in Fannie Mae and $72 billion in Freddie Mac. In return, the U.S. Treasury was granted preferred stock in each company.

Back then, it seemed the bleeding would never end. The best taxpayers could hope for was a dismantling or replacement of the GSEs at the hope that the public loss would somehow be limited. In an attempt to realize a minimal loss, the government altered the terms of the companies' dividend obligations and required them to return any net worth to the government at a rate of 100%. What has happened since then has been dramatic.

It is always darkest before the dawn, and in those dark days, hardly anyone would have said that Fannie and Freddie could ever pay back the monies drawn from the U.S. Treasury. But, that payback did finally occur, last quarter for both companies. However, the Federal Housing Finance Agency, conservator for both Fannie Mae and Freddie Mac, continues to receive 100% of the net worth of both companies in their latest quarterly reports.

Current Numbers

Fannie Mae beats on revenue

- Fannie Mae: Q1 Net income of $5.7B

- Revenue of $9.1B (+31.9% Y/Y) beats by $3.48B.

Fannie Mae net income of $5.3B, expects to remain profitable

- Fannie Mae Q1 net income of $5.3B vs. $5.7B in Q4, and includes $4.1B in revenue from legal settlements.

- Expected $5.7B dividend payment to Treasury will bring total to $126.8B vs. $116.1B in draws.

- "Fannie Mae expects to remain profitable for the foreseeable future," but annual net income going forward should be "substantially lower" than 2013.

To access the 8K announcement for Fannie Mae , use this link.

Freddie Mac reports Q1 profit

- Freddie Mac : Q1 Net income of $4B.

- Net interest income of $3.5B (-7.9% Q/Q).

Freddie joins Fannie in warning on future profits

- Q1 net income of $4B vs. $8.6B in Q4. The Q1 result includes $3.4B in after-tax legal settlements and $1.6B in after-tax losses on interest rate hedges.

- It's the 10th consecutive quarter of positive earnings, but "The recent level of earnings is not sustainable over the long term," says Freddie Mac (FMCC +1.5%).

- The June dividend obligation to Treasury will be $4.5B, brining total to $83.6B vs. $72.3B in draws.

To access the 8K announcement for Freddie Mac , use this link.

Crossing the Line

Hindsight is indeed 20/20. Back in the day, when no one thought the companies would ever see profitability again, or that by now they would have been replaced by a more modern, more well capitalized public/private entity, no one questioned the terms of conservatorship set forth in the purchase agreements, and no one questioned the amendments to those agreements that brought us to where we are today.

Hindsight is indeed 20/20. Back in the day, when no one thought the companies would ever see profitability again, or that by now they would have been replaced by a more modern, more well capitalized public/private entity, no one questioned the terms of conservatorship set forth in the purchase agreements, and no one questioned the amendments to those agreements that brought us to where we are today.

With respect to Fannie Mae: "Our conservatorship has no specified termination date, and we do not know when or how the conservatorship will terminate, whether we will continue to exist following conservatorship, what changes to our business structure will be made during or following the conservatorship, or what ownership interest, if any, our current common and preferred stockholders will hold in us after the conservatorship is terminated." - source Annual Report (10K), Item 1 - Business.

To date, the Treasury has collected almost $127 billion in dividends from the company. However, under the last amendment of the senior preferred stock purchase agreement, these dividend payments have not offset even the first penny of draws. So, Fannie Mae still owes U.S. taxpayers the whole $117 billion.

And, with respect to Freddie Mac: "The Purchase Agreement has an indefinite term and can terminate only in limited circumstances, which do not include the end of the conservatorship. The Purchase Agreement therefore could continue after the conservatorship ends. Treasury has the right to exercise the warrant, in whole or in part, at any time on or before September 7, 2028." - source Annual Report (10K), Note 2 - CONSERVATORSHIP AND RELATED MATTERS.

To date, the Treasury has collected more than $86 billion in dividends from the company. However, just like with Fannie Mae, under the last amendment of the senior preferred stock purchase agreement, these dividend payments have not offset even the first penny of draws Freddie Mac has taken. So, Freddie Mace still owes U.S. Taxpayers the whole $71 billion.

That's a pretty sweet deal the Treasury has going on - $1.13 in "dividends" for every dollar invested, in just a five-year period. I'm sure any investor out there would like to get a return on investment like that.

However, in light of the new reality that we live in, now is the time for the Federal Housing Finance Agency to once again amend the purchase agreements to seek an end to conservatorship and return the companies to the common shareholders, considering the Treasury has realized more than a normal profit for taxpayers.

Failure to do so is a failure of their fiduciary duties with respect to their creation under United States Code TITLE 12 §4617 to "preserve and conserve the assets and property of the regulated entity."

Legally, the net worth accumulated by the companies' belong to the shareholders, including the common shareholders. However, under the current amendment, 100% of those monies are being confiscated by the U.S. Treasury as dividends, thereby stealing from the common shareholder.

Thieves?

And, it is not just this author's opinion that the U.S. Treasury has overstepped its bounds on this one. One of the best arguments has been put forth by Jonathan Macey and Logan Beirne of Yale law school in their whitepaper Stealing Fannie and Freddie.

Mesrrs. Macey and Beirne state, "In pursuing their mandate to protect the third party taxpayers, the government is neglecting its duties to the shareholders - something that under traditional corporate law runs counter to a conservator's role."

Mesrrs. Macey and Beirne state, "In pursuing their mandate to protect the third party taxpayers, the government is neglecting its duties to the shareholders - something that under traditional corporate law runs counter to a conservator's role."

It is completely understandable that the Federal Housing Finance Agency needed to look out for the interest of the taxpayers in the early days of conservatorship, but now that their interest has been met, whose interest are they looking out for now? Should it be the shareholders or the politicians in Washington DC greedily eyeing the profit potential to be realized from perpetually pilfering the profits of these two GSEs?

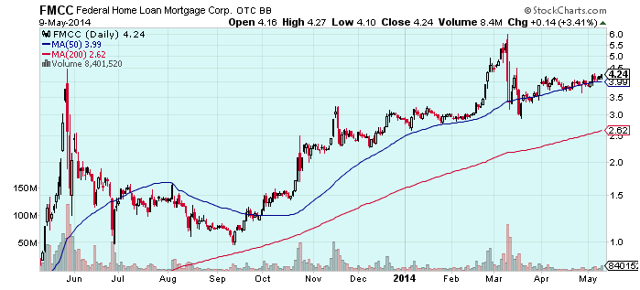

Common Stock Share Price

In the dark days of "perpetual" draws against the U.S. Treasury purchase agreement, the share price of both companies plunged to the point where both stocks traded in the pennies per share. As a result, both companies were delisted and have since traded on the OTC markets. However, they have continued to report, and have not fallen behind in the companies reporting obligations.

This time last year, as investors began to realize that the companies would inevitably "pay off" their obligation to the U. S. Treasury, share prices have come off their lows, and have been trading well above $1.00 per share.

With the shares now in the $4.00 per share price range, now should be the time for the companies to re-list on a major exchange, for the benefit of the shareholders. However, that would require action by the board, but only if permissible by the conservator. The question is, will the Federal Housing Finance Agency permit such a thing? If they hold true to their fiduciary responsibility and act in the interest of the shareholders, Fannie and Freddie should return to the Big Board. And that could have considerable positive potential for shareholders.

Ackman Says It's a 10-Bagger

Bill Ackman's Pershing Square Capital Management certainly thinks the value of the common shares have potential. In a recent presentation to the Ira Sohn Conference the firm estimates the future value of fully capitalized GSEs to be between 6 to 12 times their current per share value in just seven to ten years. (source Pershing Square)

Granted, Ackman is famous for talking his book, but in the universe that he lives and operates, all activist investors and hedge fund managers talk their book. Therefore, we should expect Ackman to throw his weight behind this since Pershing has accumulated a 10% stake in the companies. But, somewhere out there, others are accumulating shares quietly.

In the past, Fannie and Freddie have been two of the most actively traded issues on the OTC. But, the dollar value per trade has begun to climb recently, indicating that it is not just individual investors taking a stake in these companies. So, one could expect other activists will soon emerge to put further pressure to allow the companies to rebuild their capital structures and hence add to common shareholder value.

Summary

Now, I wouldn't expect to see such a rapid rise in per share value over the short run, however the more institutional shareowners there are to put pressure on the Federal Housing Finance Agency to look out for the interest of shareholders the better. And, since the best way to attract and retain quality institutional investors is to list and trade on a major exchange, I encourage the conservator to re-list the shares on NYSE. The sooner, the better.

Get Aunt Fannie and Uncle Freddie back in the big show.

Comments

Post a Comment