Fannie Mae And Freddie Mac's whats behind screen

Summary

Anthony Piszel breach of contract claim is preserved. GSE Preferred Shareholder's breach of contract claim is their strongest claim. This is the one made by Hamish Hume in Appeals Court.

The argument that the government made that it can operate the GSEs outside of Delaware law raises more questions than answers.

The key to this nationalization is government accounting and inter-agency agreements designed to promote the public perception that the GSEs were losing money when they were making money.

The regulator has quietly examined whether it can suspend the payments unilaterally to build up the GSEs’ capital cushion, among other options.

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are government-sponsored enterprises. Government-sponsored enterprises (GSEs) are a group of financial services corporations created by the United States Congress. The United States GSEs are private corporations owned by their stockholders, rather than government-owned corporations. Their primary function is to generate profits for their stockholders, but they are structured and regulated by the U.S. government to enhance the availability and reduce the cost of credit to targeted borrowing sectors. Government sponsored enterprises include:

- Fannie Mae

- Farmer Mac

- Federal Home Loan Banks

- Freddie Mac

- Ginnie Mae

In 2008, the Federal Housing Finance Agency (FHFA) put two Fortune 50 companies Fannie and Freddie into conservatorship. Once in conservatorship, the government manipulated the financial statements to simultaneously write down assets and issue itself enough preferred stock to subsequently justify seizing all of the profits in perpetuity for nothing in exchange. The government has taken over $100B out of the GSEs since conservatorship began and forecasts taking even more than that in the coming decades. In the process, the government raised g-fees and says capital levels don't matter but runs stress tests on Fannie and Freddie to make them look bad anyway.

Investment Thesis: Lawsuits have been filed, some of which have been amended, fighting specific parts of what's transpired under the veil of conservatorship. The government's defense is that it can do whatever it wants and the facts don't matter. In state courts, it seems that the government is arguing that not only it, but also the accounting firms who signed off on the audits, are immune from judicial scrutiny.

Owning equity shares in Fannie Mae and Freddie Mac is a bet that some portion of the companies' earnings escapes the gravitational pull of the housing trust funds, the insiders making a fortune on the 'risk-sharing' deals, and the government. Combined, Fannie Mae and Freddie Mac earn $12-$25B/annum. Preferred shareholders have their upside limited to par value while common shareholders have their upside limited by FHFA's subsequent interpretation of their legal options in the event that their plan to take everything through the net worth sweep is foiled by a legal ruling. Richard Bove and William Ackman think that this starts at $20, but those estimates assume 79.9% dilution. Perhaps Judge Sweeney's Court of Claims produces discovery that eventually can be used to mute the impact of the warrants or perhaps at that point in time FHFA has already executed one of its Plan B's. AIG is an example where common shareholders kept 7.9%.

Anthony Piszel Beats Can't Sue Defense

Anthony Piszel didn't argue breach of contract against Freddie Mac. Mr. Piszel also beat the government's can't sue defense. It was ruled that it wasn't a taking because it was an enforceable breach of contract and action should be brought as such:

The court effectively ruled that nothing was taken when the contract was voided, however, Mr. Piszel was harmed by a valid breach of contract claim that should be brought. If you're an investor, the important part is that conservatorship can't void contracts and that taking occurred.

The filing goes on to show which part of the statute preserves the breach of contract claim:

Breach of contract is the preferred stocks strongest claim. As a preferred shareholder this ruling is a huge win.

Countering The Government's Latest Delaware Arguments

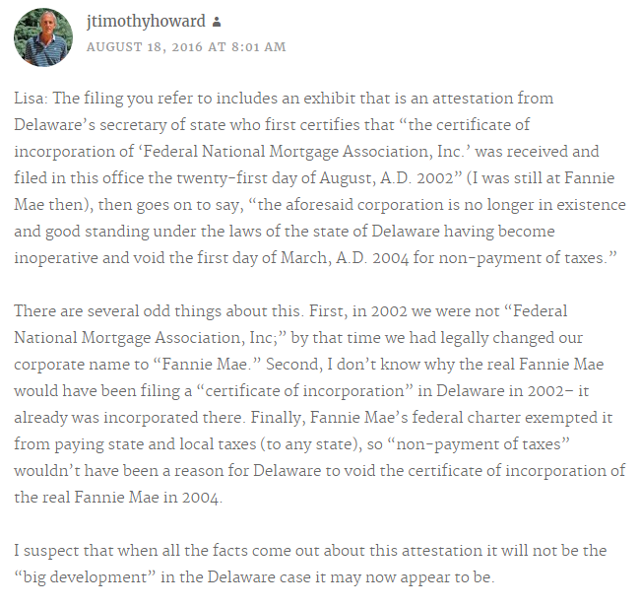

In my prior article, I tried to raise awareness around FHFA's argument that they have escaped judicial scrutiny as it relates to Delaware. Since then, prior CFO Tim Howard has weighed in and so too has another legal mind.

Prior Fannie Mae CFO Tim Howard offered the perspective that the government's perspective may not survive added scrutiny:

Another legal mind suggests:

Failure to pay franchise tax resulted in the Secretary of State voiding the Delaware charter. Does not change our view that the statue authorized them to choose their internal governance scheme and they chose Delaware. There is no indication they have chartered in California or any other state. The feds maintain that Fannie Mae is really a federal corporation and that after their coup d'état, the bylaw choosing Delaware was repealed.This will be sorted all along with all the other issues.

As usual, it seems that the government's argument doesn't carry as much weight as you may be led to believe based on your first impression if you're reading it cold. I'm not a lawyer, so on these things I generally defer to people who are or have first-hand experience.

Case Study on Regulatory Capture: FHFA

Regulatory capture is a form of government failure that occurs when a regulatory agency, created to act in the public interest, instead advances the commercial or political concerns of special interest groups that dominate the industry or sector it is charged with regulating. When regulatory capture occurs the interests of firms or political groups are prioritized over the interests of the public, leading to a net loss to society as a whole. Government agencies suffering regulatory capture are called "captured agencies".

In the case of FHFA, public nomenclature pushes forth risk-sharing and risk-transfer deals which are really double-speak for profit-sharing and extortion payments. Prior CFO Timothy Howard has demonstrated that by design these deals do not share material risk and merely result in Fannie Mae and Freddie Mac giving away money to people who have enough money to participate in these "deals of a lifetime."

Summary & Conclusion

This may look like money in the bank from the standpoint of, "Shouldn't it be illegal for the government to step in and drain a private company of all its capital for nothing?" Richard Epstein discounts this by saying that it doesn't matter how right you are, when you're fighting the government a 50% probability of success is a generous high end estimate. So far, plaintiffs have not been able to make it past a motion to dismiss, which by uninformed accounts amounts to a pretty pathetic showing.

The reality in this case is that the government has actively withheld over 10,000 documents from discovery and bypassed the DC District Court by putting together an incomplete and misleading assortment of documents. Fortunately, plaintiffs in the Court of Claims were able to produce enough documents to prove this. With a handful of these documents made public and more lawsuits filed since the Lamberth dismissal, GSE equity investors are in good shape for upcoming rulings.

It's sort of like robbing someone and when the cops show up and you have all their money claiming that it wasn't their money in the first place and that without you coming to save them they would have been defenseless. If that's not enough, the paper trail of cash profits and transfers shows that it was their money and they would have been better off without you. Nevertheless, the government continues to take every nickel and dime out of Fannie Mae and Freddie Mac and the status quo renders equity shares worthless if the judiciary system permits the government to continue on its current trajectory.

Disclosure: I am/we are long FMCCH,FMCCP,FMCCT,FMCKI,FMCKO,FMCKP,FNMFN,FNMFO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Comments

Post a Comment