Fear Unilateral Action for FNMA That Ends Conservatorship

Senators Who Advocate Shorting GSEs Fear Unilateral Action That Ends Conservatorship

Summary

Senators writing director of FHFA warning not to take action that could lead to end of conservatorship implies the director of FHFA could take such action.

Judge Thapar apparently has 16 shares of Fannie Mae.

The new hurdle 4623(d) is being brought up in Kentucky as well.

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are Fortune 50 private companies, government sponsored enterprises, political footballs, and in conservatorship managed by the government for the government. On a net basis, conservatorship has allowed FHFA to deploy accounting statements that across time and a change of terms will reclassify the net worth of the GSEs as government revenue, which so far has been over $100B since the imposition of conservatorship. Since parts of HERA are identical to the FDIA which governs the FDIC, the read through to what the government could do to other companies it places into conservatorship is that it could take their net worth for nothing, too. Fortunately, lawsuits have been brought to fight the nationalization, saying that the law was broken and FHFA cannot as conservator steal the assets of its conservatee. So far, no shareholder lawsuit has been able to get past the government motion to dismiss, but that is subject to change.

Investment Opportunity

In warning Watt of what not to do, the senators made it abundantly clear that he has the option to do. In a conservatorship where the conservator is paying cash dividends to a related party to make the conservatee insolvent on purpose, any action that changes this could have a positive impact on the value of equity securities. This latest letter that warns director Watt not to do something implies that he has the power to do something that benefits non-governmental shareholders. In the event that the GSEs are allowed to retain capital, equity shares may eventually have a non-zero intrinsic value. Common share valuations by Richard X. Bove and William Ackman are in the neighborhood of $20, seeing as how combined the two GSEs can be expected to earn $15B/annum and the government is sitting on 80% warrant coverage that it issued to itself. Right now, those warrants are worthless because the government is taking all of the money anyway, but there are scenarios that may play out where they have some sort of value.

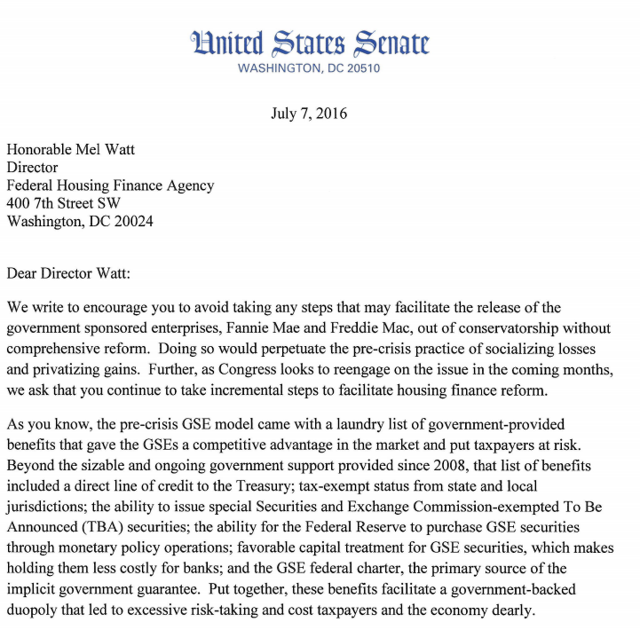

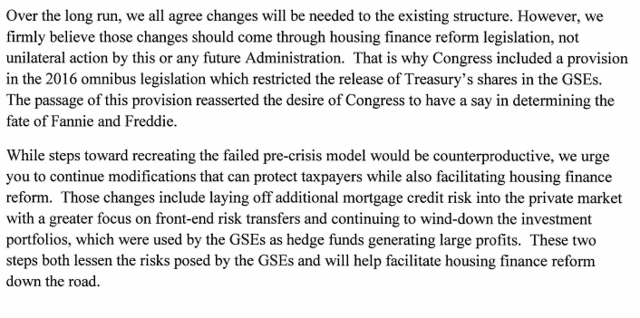

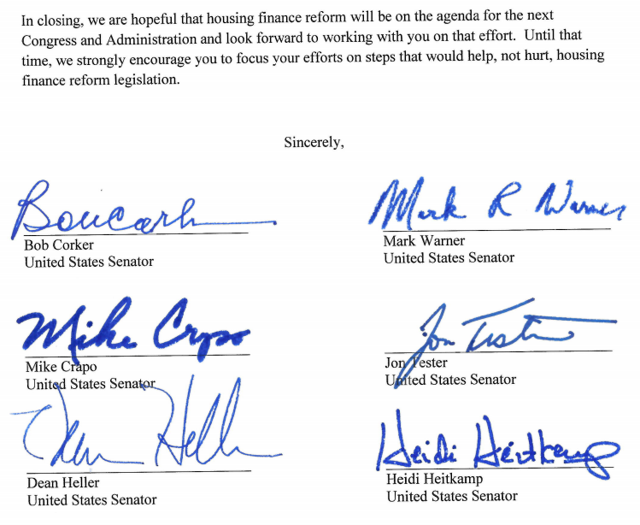

Anti-GSE Senators Write Watt Implying He Has Power To End Conservatorship Without Legislation

Six senators wrote a letter to FHFA Director Mel Watt. It will be interesting to see if this letter is referenced in Treasury's or FHFA's briefs due next week in the Appeals court. Because the letter encourages director Watt to avoid taking steps that may facilitate the release of the GSEs, it seems to suggest that the opposite is at the very least possible.

Senator Bob Corker in the past has publicly advocated shorting Fannie Mae.

Corker, who has failed to advance legislation he co-wrote to wind down Fannie and Freddie, said that Congress has been "inept" in not tackling the issue.

Mark Warner and Bob Corker have also profited from the financial crisis. Mike Crapo has worked on the demise of Fannie and Freddie in the past. To provide contrast, 32 members of the Congress last month recommended the opposite. In addition, director Watt has pointed out that what FHFA did before he got there involved an agreement that trumped the law:

As such, in the long run, it might not even be up to Director Watt as to whether or not the GSEs are allowed to exit conservatorship and be recapitalized.

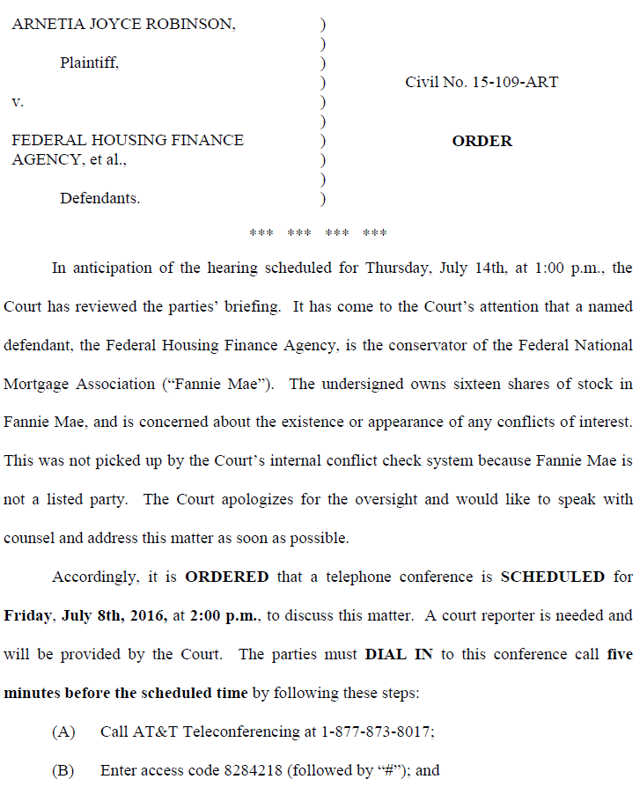

Judge Thapar Owns 16 Shares Of Fannie Mae

As such, he has scheduled a conference call to talk about it:

16 shares isn't even a round lot (100) and is basically nothing. As evidenced by the MDL, the government will likely attempt to take this statement of ownership as a fact and use it to its advantage. One would think that this can be resolved by Thapar getting rid of these 16 shares. I'm not a lawyer, buthere is what I found:

"Any justice, judge, or magistrate of the United States shall disqualify himself in any proceeding in which his impartiality might reasonably be questioned." Second, 28 USC § 455(b)(4) requires a judge to disqualify himself if he possesses any interest that could be "substantially affected by the outcome of the proceeding."

16 shares doesn't sound like substantially affected in this case; these shares are penny stocks. This is a first, and my view as a shareholder is hopefully it's not a big deal because this Judge was the judge that the plaintiffs attempted to re-route the MDL to instead of Lamberth in case the MDL wasn't denied (which it was). From the government's point of view, this is just a new opportunity to see if it can somehow eliminate another court room from inspecting its activities. Remember, according to the government, the Judge surrendered all his rights as a shareholder at the onset of conservatorship anyway, so what's the big deal?

Robinson Motion For Judge To Sell Shares

Plaintiffs have indeed filed a motion for the judge to sell the shares at question to resolve the issue:

It seems pretty straight forward, considering the equivalency of the $30-32 value of the stock cited in the example.

4623 Brought To Kentucky (Thapar)

The new defense that was brought up the day of oral arguments in the Perry Capital Appeal is now being taken on parade in other court rooms. This time it is being used in Kentucky.

It would have been interesting to see how Lamberth would have accounted for the 4623(d) argument if it was included in the first defense put forth against Perry Capital.

Summary And Conclusion

As a shareholder, it's unfortunate to hear that Judge Thapar owns shares because it may provide grounds for the government to effectively void one of the lawsuits. I have no idea. I'm not a lawyer. Fortunately, there are over a dozen other lawsuits. The biggest impact of this in my opinion is estimated timeline for potential resolution gets pushed back. Bummer.

The fact senators are writing director Watt asking him not to do anything differently implies he could if he chooses to, which is potentially good for shareholders.

4623(d) is part of the new government argument that it can do whatever it wants. Hopefully, for GSE equity shareholders, the argument is bankrupt.

Disclosure: I am/we are long FNMA, FMCCH, FMCCP, FMCCT, FMCKO, FMCKP, FNMFN, FNMFO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow this author and get email alerts

Follow Glen Bradford

Comments

Post a Comment