Hypocritic America In Business in Huma Rights in freedom and all

Episode of Fannie Mae (OTCQB:FNMA) and Freddie Mac is the best exmplae of Economic policy hypocritical behavior of America worse than socialistic manners -Private property takne over with nocompensation and gigivng the owners a run around

Double Bind FHFA Legal Arguments Undermining Ownership Rights Set To Collapse

Summary

All classes (equity and debt) of shareholders in SIFI institutions should pay close attention to GSE litigation outcomes since the FDIC is governed by the FDIA statute similar to HERA.

SIFI Banks like JPMorgan Chase seem to support FHFA's conservatorship, but have the most to lose by a similarly imposed and managed FDIC conservatorship.

Oral Arguments take place April 15, after which I expect Lamberth's ruling to be overturned sometime this fiscal year.

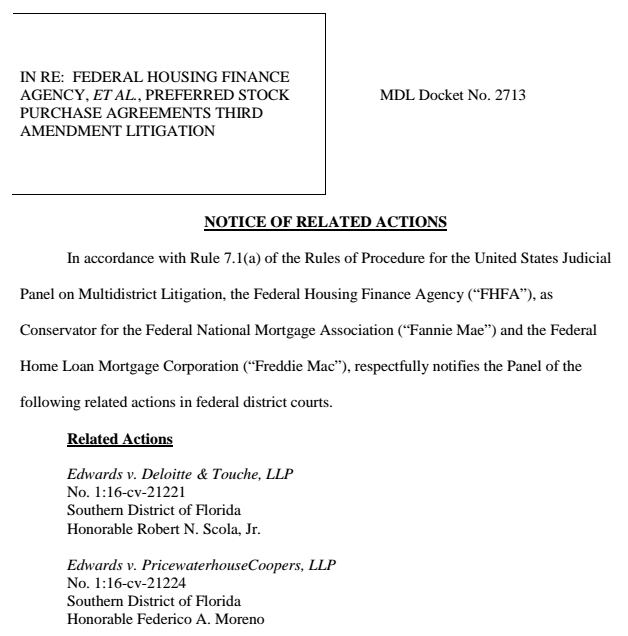

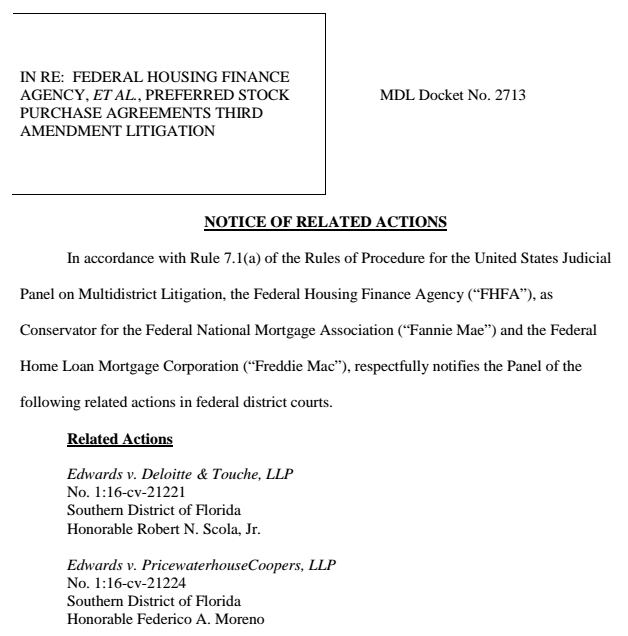

The Federal Housing Finance Agency is now looking to include lawsuits against Deloitte and PricewaterhouseCoopers in their United States Judicial Panel on Multidistrict Litigation.

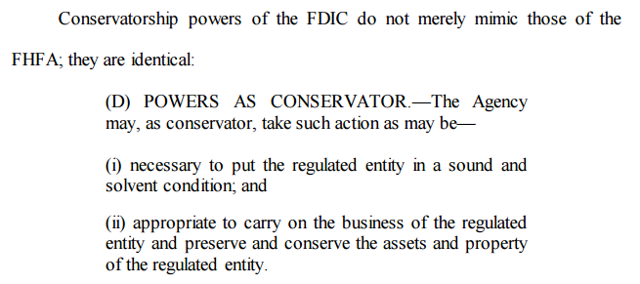

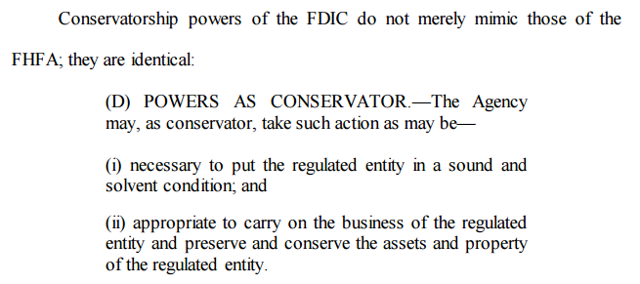

Fannie Mae (OTCQB:FNMA) and Freddie Mac are two private government sponsored enterprises that are being depleted of their capital by 2018. Each year, Fortune ranks the top companies. Fannie Mae and Freddie Mac areFortune 50 companies. Since 2008, FHFA has been the conservator of Fannie Mae and Freddie Mac. The Housing and Economic Recovery Act of 2008 (HERA) is the body of law governing FHFA's actions as conservator and it was modeled after the FDIA, which governs the FDIC:

Because similar bodies of law govern SIFIs and the GSEs, one would presume that there is a trading opportunity here. If the GSEs are subject to conservatorship law whereby their securities can be stripped of their economic value, then so too are other financial institutions, specifically the SIFIs. One trade here would be to short SIFI institutions and go long the GSEs. If conservatorship law enables conservators to violate established solvency principles, then the GSEs and the SIFIs would both go down, but the SIFIs would go down proportionally more than the GSEs, which are already priced for incoming insolvency. On the other hand, if conservatorship law dictates that a conservator must conserve the assets of the conservatee, then the GSEs should be expected to outperform the banks on the upside. Richard X. Bove and William Ackman have suggested $20 on the commons to be a reasonable price.

FDIC and SIFI Implications

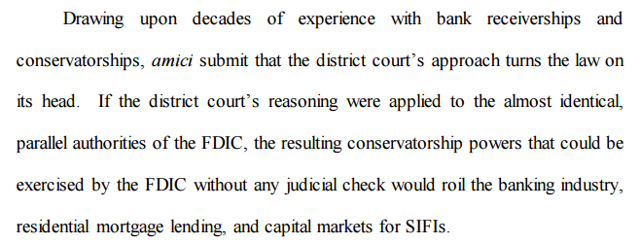

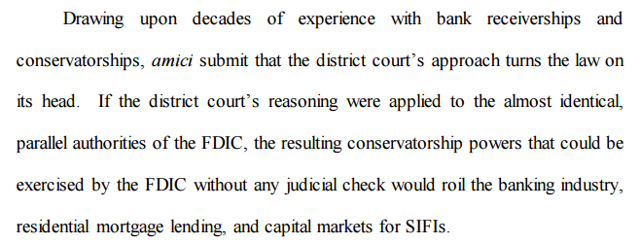

The Independent Community Bankers of America have suggested that FHFA's interpretation of the HERA may lead to similar interpretations of the FDIA by the FDIC:

Because similar bodies of law govern SIFIs and the GSEs, one would presume that there is a trading opportunity here. If the GSEs are subject to conservatorship law whereby their securities can be stripped of their economic value, then so too are other financial institutions, specifically the SIFIs. One trade here would be to short SIFI institutions and go long the GSEs. If conservatorship law enables conservators to violate established solvency principles, then the GSEs and the SIFIs would both go down, but the SIFIs would go down proportionally more than the GSEs, which are already priced for incoming insolvency. On the other hand, if conservatorship law dictates that a conservator must conserve the assets of the conservatee, then the GSEs should be expected to outperform the banks on the upside. Richard X. Bove and William Ackman have suggested $20 on the commons to be a reasonable price.

FDIC and SIFI Implications

The Independent Community Bankers of America have suggested that FHFA's interpretation of the HERA may lead to similar interpretations of the FDIA by the FDIC:

In America, the banks identified as SIFIs are:

In America, the banks identified as SIFIs are:

- Bank of America (NYSE:BAC)

- Bank of New York Mellon (NYSE:BNY)

- Citigroup (NYSE:C)

- Goldman Sachs (NYSE:GS)

- JPMorgan Chase (NYSE:JPM)

- Morgan Stanley (NYSE:MS)

- State Street (NYSE:STT)

- Wells Fargo (NYSE:WFC)

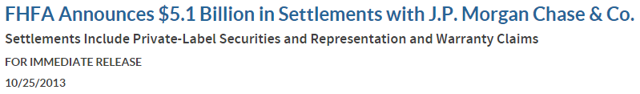

Jamie Dimon - JPMorgan Chase

In JPMorgan Chase's most recent annual report, Jamie Dimon suggests that Fannie Mae and Freddie Mac are costly to the U.S. government:

Fannie Mae and Freddie Mac. These are examples of poor policy at the industry and company level. Under government auspices and with federal government urging, Fannie and Freddie became the largest, most leveraged and most speculative vehicles that the world had ever seen. And when they finally collapsed, they cost the U.S. government $189 billion. Their actions were a critical part of the failure of the mortgage market, which was at the heart of the Great Recession. Many people spent time trying to figure out who was to blame more - the banks and mortgage brokers involved or Fannie and Freddie. Here is a better course - each should have acknowledged its mistakes and determined what could have been done better.

It sounds to me like someone forgot that they got off easy:

The actual amount of money invested into Fannie and Freddie was only$132.2B (not $189B as Dimon puts it) and this amount is primarily due to massive unprecedented accounting writedowns that were subsequently reversed after the third amendment. According to Judge Lamberth's interpretation of the law, it doesn't matter why FHFA does what it does. In theory, FHFA could have entered into the net worth sweep the first day of conservatorship when Fannie Mae and Freddie Mac had their highest levels of capital in history. According to ProPublica, Fannie Mae and Freddie Mac have paid $246B in dividends to Treasury, meaning that since conservatorship started, Fannie Mae and Freddie Mac have on a net basis paid Treasury $113.8B.

Double Bind - Catch-22

A double bind is an emotionally distressing dilemma in communication in which an individual (or group) receives two or more conflicting messages, and one message negates the other. In this case, the double bind is that Treasury officials say that Fannie Mae and Freddie Mac are broken business models in the same context that they have taken $113.8B on top of taxes since they've taken control of the GSEs.

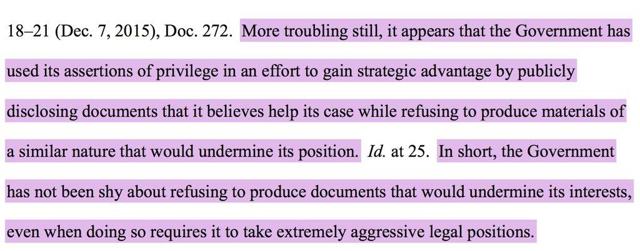

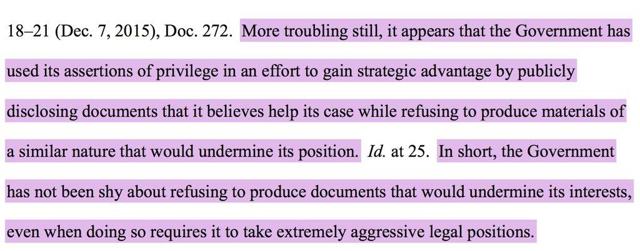

Double binds are often utilized as a form of control without open coercion - the use of confusion makes them both difficult to respond to as well as to resist. A Catch-22 is a dilemma or difficult circumstance from which there is no escape because of mutually conflicting or dependent conditions. In this case, the Catch-22 is that as we've found out in Lamberth's court, it is possible to rule on an incomplete administrative record favoring the government while the incomplete administrative record only includes information favoring the government's legal position:

The actual amount of money invested into Fannie and Freddie was only$132.2B (not $189B as Dimon puts it) and this amount is primarily due to massive unprecedented accounting writedowns that were subsequently reversed after the third amendment. According to Judge Lamberth's interpretation of the law, it doesn't matter why FHFA does what it does. In theory, FHFA could have entered into the net worth sweep the first day of conservatorship when Fannie Mae and Freddie Mac had their highest levels of capital in history. According to ProPublica, Fannie Mae and Freddie Mac have paid $246B in dividends to Treasury, meaning that since conservatorship started, Fannie Mae and Freddie Mac have on a net basis paid Treasury $113.8B.

Double Bind - Catch-22

A double bind is an emotionally distressing dilemma in communication in which an individual (or group) receives two or more conflicting messages, and one message negates the other. In this case, the double bind is that Treasury officials say that Fannie Mae and Freddie Mac are broken business models in the same context that they have taken $113.8B on top of taxes since they've taken control of the GSEs.

Double binds are often utilized as a form of control without open coercion - the use of confusion makes them both difficult to respond to as well as to resist. A Catch-22 is a dilemma or difficult circumstance from which there is no escape because of mutually conflicting or dependent conditions. In this case, the Catch-22 is that as we've found out in Lamberth's court, it is possible to rule on an incomplete administrative record favoring the government while the incomplete administrative record only includes information favoring the government's legal position:

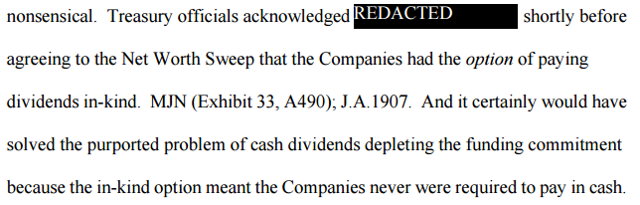

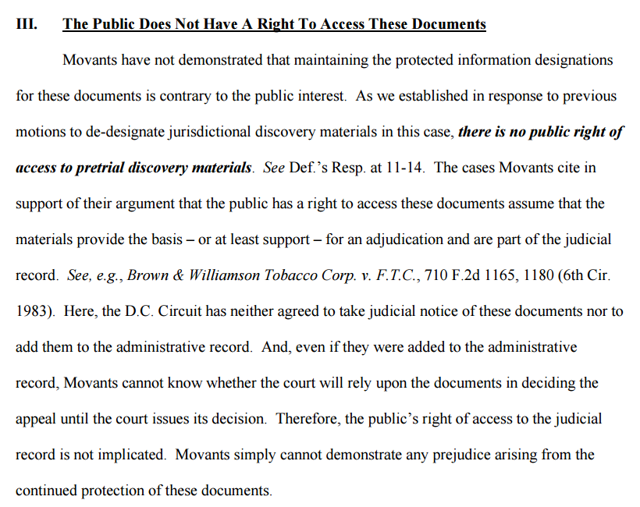

With oral arguments coming up this Friday, the government continues to fight against plaintiffs talking about what's behind redactions in plaintiff's briefs:

With oral arguments coming up this Friday, the government continues to fight against plaintiffs talking about what's behind redactions in plaintiff's briefs:

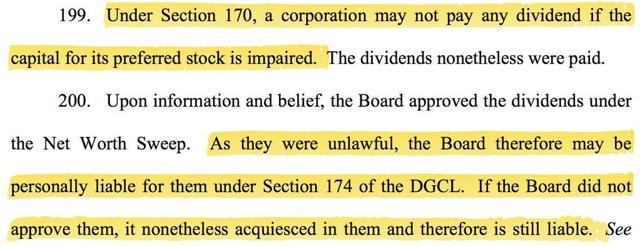

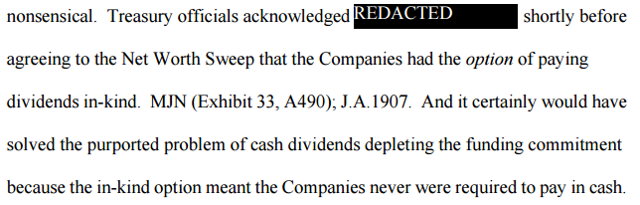

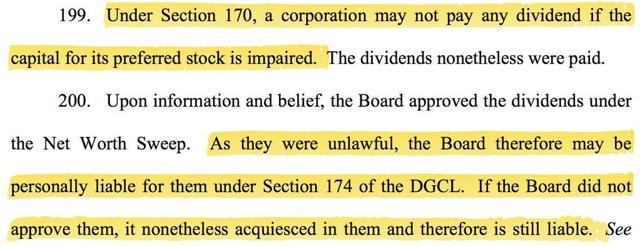

It is self-evident that Treasury officials considered dividends in kind. The implication is that Fannie Mae and Freddie Mac were being controlled by the government agency FHFA when they decided to sweep their net worth to the government to avert a cash shortage crisis that didn't actually exist. Further, according to plaintiff interpretations of state law in another suit, the government shouldn't have been able to legally pay themselves dividends at all:

It is self-evident that Treasury officials considered dividends in kind. The implication is that Fannie Mae and Freddie Mac were being controlled by the government agency FHFA when they decided to sweep their net worth to the government to avert a cash shortage crisis that didn't actually exist. Further, according to plaintiff interpretations of state law in another suit, the government shouldn't have been able to legally pay themselves dividends at all:

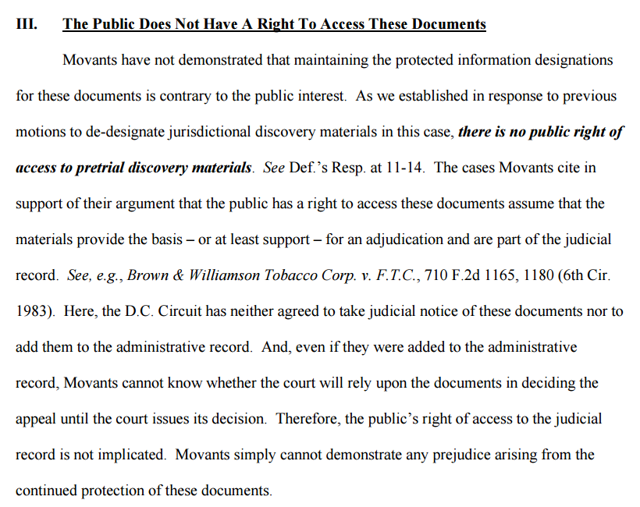

Not surprisingly, plaintiffs want to discuss the facts of what actually happened and have been fought tooth and nail at every turn. At present, FHFA and Treasury are contesting plaintiff motions to allow discussion of discovery documents, included in their merits briefs during oral arguments this Friday:

Not surprisingly, plaintiffs want to discuss the facts of what actually happened and have been fought tooth and nail at every turn. At present, FHFA and Treasury are contesting plaintiff motions to allow discussion of discovery documents, included in their merits briefs during oral arguments this Friday:

Judge Sweeney has been allowing discovery materials to propagate under seal to multiple courts including this Appeals Court. This upcoming week could be game changing depending on how Sweeney rules on motions that have been filed under seal by plaintiffs.

Consolidation of Auditor and Other Cases

Further, FHFA and Treasury are now looking to insulate the auditor actions of PricewaterhouseCoopers and Deloitte:

Judge Sweeney has been allowing discovery materials to propagate under seal to multiple courts including this Appeals Court. This upcoming week could be game changing depending on how Sweeney rules on motions that have been filed under seal by plaintiffs.

Consolidation of Auditor and Other Cases

Further, FHFA and Treasury are now looking to insulate the auditor actions of PricewaterhouseCoopers and Deloitte:

What's ironic here is that plaintiffs are suing for blatant accounting manipulations favoring self-dealing and the government appears on the surface to be assisting in covering it up. Maybe it follows that because FHFA and Treasury can do whatever they want, then by extension, the auditors of Fannie Mae and Freddie Mac can do whatever they want while their actions during conservatorship are also shielded from public scrutiny. Investors Unite's Tim Pagliara, has filed suits to inspect the books of Fannie Mae and Freddie Mac and that has also been an uphill battle.

My preliminary understanding is that the government is looking to consolidate all of these cases to Judge Royce Lamberth, who has ruled in their favor:

What's ironic here is that plaintiffs are suing for blatant accounting manipulations favoring self-dealing and the government appears on the surface to be assisting in covering it up. Maybe it follows that because FHFA and Treasury can do whatever they want, then by extension, the auditors of Fannie Mae and Freddie Mac can do whatever they want while their actions during conservatorship are also shielded from public scrutiny. Investors Unite's Tim Pagliara, has filed suits to inspect the books of Fannie Mae and Freddie Mac and that has also been an uphill battle.

My preliminary understanding is that the government is looking to consolidate all of these cases to Judge Royce Lamberth, who has ruled in their favor:

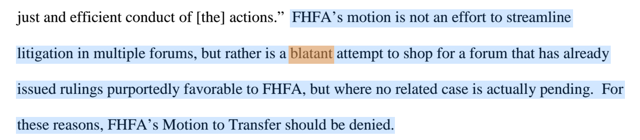

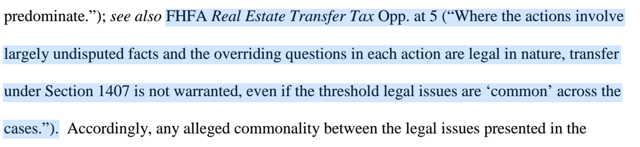

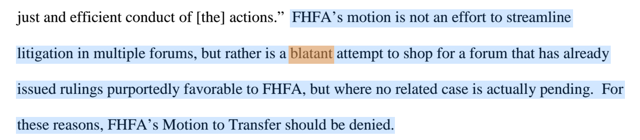

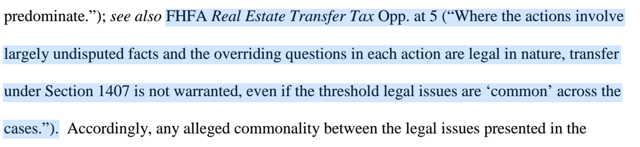

Plaintiffs even go as far as to quote FHFA's own arguments against FHFA's efforts to consolidate:

Plaintiffs even go as far as to quote FHFA's own arguments against FHFA's efforts to consolidate:

We'll probably learn a lot more about these motions to consolidate sometime between Perry Capital's oral arguments and the subsequent ruling. Look forward to Judge Sweeney's ruling on Fairholme's Motion To Compel in the Court of Claims.

Summary & Conclusion

Because HERA is virtually the same as the FDIA, it would stand to reason that there is an interesting opportunity pairs to trade the GSEs and SIFIs. Personally, I am going long the GSEs. I made a lot of trades since my last article and now own 64590 shares of FNMAJ, 15989 of FMCKI, 9340 shares of FMCCP, 5000 shares of FMCKP, 3500 shares of FMCCT, and 1402 shares of FMCKO. These are preferred securities in Fannie Mae and Freddie Mac with a total par value of $3,144,025 and I have borrowed around $240,000 in order to take this position.

I am expecting a favorable legal outcome sometime this year for plaintiffs. I have set myself up for a binary outcome. Either I am bankrupt and I default on my loans that I borrowed from SIFI institutions or as the former Chief Justice of the Supreme Court of Delaware Myron T. Steele puts it:

We'll probably learn a lot more about these motions to consolidate sometime between Perry Capital's oral arguments and the subsequent ruling. Look forward to Judge Sweeney's ruling on Fairholme's Motion To Compel in the Court of Claims.

Summary & Conclusion

Because HERA is virtually the same as the FDIA, it would stand to reason that there is an interesting opportunity pairs to trade the GSEs and SIFIs. Personally, I am going long the GSEs. I made a lot of trades since my last article and now own 64590 shares of FNMAJ, 15989 of FMCKI, 9340 shares of FMCCP, 5000 shares of FMCKP, 3500 shares of FMCCT, and 1402 shares of FMCKO. These are preferred securities in Fannie Mae and Freddie Mac with a total par value of $3,144,025 and I have borrowed around $240,000 in order to take this position.

I am expecting a favorable legal outcome sometime this year for plaintiffs. I have set myself up for a binary outcome. Either I am bankrupt and I default on my loans that I borrowed from SIFI institutions or as the former Chief Justice of the Supreme Court of Delaware Myron T. Steele puts it:

Perry Capital court's reasoning is utterly bankrupt, and this Court should repudiate it.

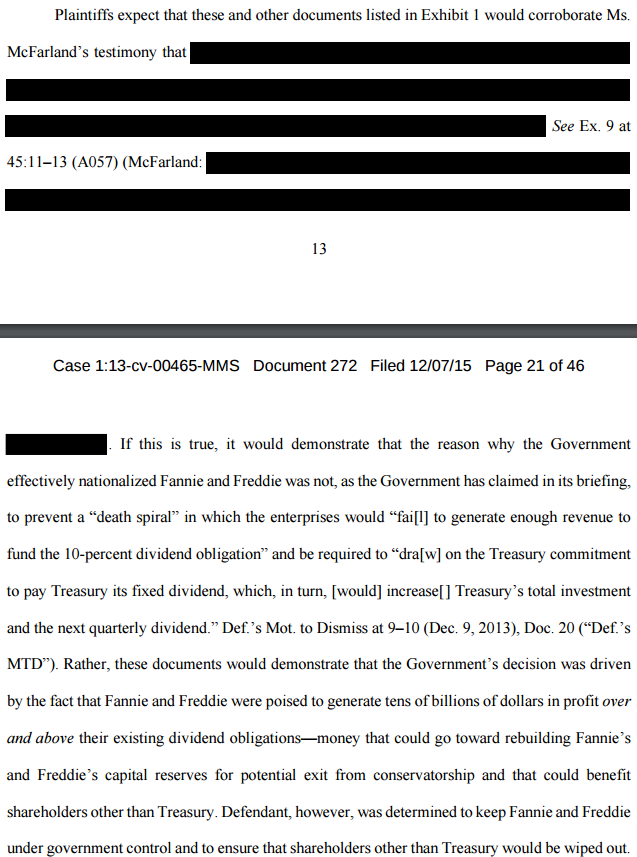

I would own common shares of Fannie Mae and Freddie Mac if FHFA wasn't in charge, and I would probably own the SIFI bank stocks if Fannie Mae and Freddie Mac were never placed into conservatorship. Unfortunately, as a matter of public policy, Fannie Mae and Freddie Mac were used as scapegoats to absolve the real culprits of the mortgage-backed security crisis of 2008. The CFO at the time of the net worth sweep even seems to corroborate the plaintiff's story that the government nationalization was to wipe out non-government shareholders:

Time will tell if conservatorships can be used to wipe out minority stakeholders, at which point, it would seem that I would be applying for jobs at the FDIC as an internal expert of how FHFA did the GSEs in. As the capital buffer at Fannie Mae and Freddie Mac continues to erode per the wind-down plan, it is increasingly interesting that the debt securities that are just beneath the surface trade as highly as they do. If I'm wrong about Fannie Mae and Freddie Mac, then perhaps so too are those that invest in the securities that they issue. The government singling out minorities who do not have a controlling interest to take their economic value is what I'm betting against by owning equity shares of Fannie Mae and Freddie Mac.

Disclosure: I am/we are long FNMAJ, FNMAS, FMCCP, FMCKI, FMCKO, FMCKP, FMCCT, FMCKJ, FMCCH, FNMA, FMCC, FMCKJ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Time will tell if conservatorships can be used to wipe out minority stakeholders, at which point, it would seem that I would be applying for jobs at the FDIC as an internal expert of how FHFA did the GSEs in. As the capital buffer at Fannie Mae and Freddie Mac continues to erode per the wind-down plan, it is increasingly interesting that the debt securities that are just beneath the surface trade as highly as they do. If I'm wrong about Fannie Mae and Freddie Mac, then perhaps so too are those that invest in the securities that they issue. The government singling out minorities who do not have a controlling interest to take their economic value is what I'm betting against by owning equity shares of Fannie Mae and Freddie Mac.

Disclosure: I am/we are long FNMAJ, FNMAS, FMCCP, FMCKI, FMCKO, FMCKP, FMCCT, FMCKJ, FMCCH, FNMA, FMCC, FMCKJ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

All classes (equity and debt) of shareholders in SIFI institutions should pay close attention to GSE litigation outcomes since the FDIC is governed by the FDIA statute similar to HERA.

SIFI Banks like JPMorgan Chase seem to support FHFA's conservatorship, but have the most to lose by a similarly imposed and managed FDIC conservatorship.

Oral Arguments take place April 15, after which I expect Lamberth's ruling to be overturned sometime this fiscal year.

The Federal Housing Finance Agency is now looking to include lawsuits against Deloitte and PricewaterhouseCoopers in their United States Judicial Panel on Multidistrict Litigation.

Fannie Mae (OTCQB:FNMA) and Freddie Mac are two private government sponsored enterprises that are being depleted of their capital by 2018. Each year, Fortune ranks the top companies. Fannie Mae and Freddie Mac areFortune 50 companies. Since 2008, FHFA has been the conservator of Fannie Mae and Freddie Mac. The Housing and Economic Recovery Act of 2008 (HERA) is the body of law governing FHFA's actions as conservator and it was modeled after the FDIA, which governs the FDIC:

Because similar bodies of law govern SIFIs and the GSEs, one would presume that there is a trading opportunity here. If the GSEs are subject to conservatorship law whereby their securities can be stripped of their economic value, then so too are other financial institutions, specifically the SIFIs. One trade here would be to short SIFI institutions and go long the GSEs. If conservatorship law enables conservators to violate established solvency principles, then the GSEs and the SIFIs would both go down, but the SIFIs would go down proportionally more than the GSEs, which are already priced for incoming insolvency. On the other hand, if conservatorship law dictates that a conservator must conserve the assets of the conservatee, then the GSEs should be expected to outperform the banks on the upside. Richard X. Bove and William Ackman have suggested $20 on the commons to be a reasonable price.

FDIC and SIFI Implications

The Independent Community Bankers of America have suggested that FHFA's interpretation of the HERA may lead to similar interpretations of the FDIA by the FDIC:

In America, the banks identified as SIFIs are:

- Bank of America (NYSE:BAC)

- Bank of New York Mellon (NYSE:BNY)

- Citigroup (NYSE:C)

- Goldman Sachs (NYSE:GS)

- JPMorgan Chase (NYSE:JPM)

- Morgan Stanley (NYSE:MS)

- State Street (NYSE:STT)

- Wells Fargo (NYSE:WFC)

Jamie Dimon - JPMorgan Chase

In JPMorgan Chase's most recent annual report, Jamie Dimon suggests that Fannie Mae and Freddie Mac are costly to the U.S. government:

Fannie Mae and Freddie Mac. These are examples of poor policy at the industry and company level. Under government auspices and with federal government urging, Fannie and Freddie became the largest, most leveraged and most speculative vehicles that the world had ever seen. And when they finally collapsed, they cost the U.S. government $189 billion. Their actions were a critical part of the failure of the mortgage market, which was at the heart of the Great Recession. Many people spent time trying to figure out who was to blame more - the banks and mortgage brokers involved or Fannie and Freddie. Here is a better course - each should have acknowledged its mistakes and determined what could have been done better.

It sounds to me like someone forgot that they got off easy:

The actual amount of money invested into Fannie and Freddie was only$132.2B (not $189B as Dimon puts it) and this amount is primarily due to massive unprecedented accounting writedowns that were subsequently reversed after the third amendment. According to Judge Lamberth's interpretation of the law, it doesn't matter why FHFA does what it does. In theory, FHFA could have entered into the net worth sweep the first day of conservatorship when Fannie Mae and Freddie Mac had their highest levels of capital in history. According to ProPublica, Fannie Mae and Freddie Mac have paid $246B in dividends to Treasury, meaning that since conservatorship started, Fannie Mae and Freddie Mac have on a net basis paid Treasury $113.8B.

Double Bind - Catch-22

A double bind is an emotionally distressing dilemma in communication in which an individual (or group) receives two or more conflicting messages, and one message negates the other. In this case, the double bind is that Treasury officials say that Fannie Mae and Freddie Mac are broken business models in the same context that they have taken $113.8B on top of taxes since they've taken control of the GSEs.

Double binds are often utilized as a form of control without open coercion - the use of confusion makes them both difficult to respond to as well as to resist. A Catch-22 is a dilemma or difficult circumstance from which there is no escape because of mutually conflicting or dependent conditions. In this case, the Catch-22 is that as we've found out in Lamberth's court, it is possible to rule on an incomplete administrative record favoring the government while the incomplete administrative record only includes information favoring the government's legal position:

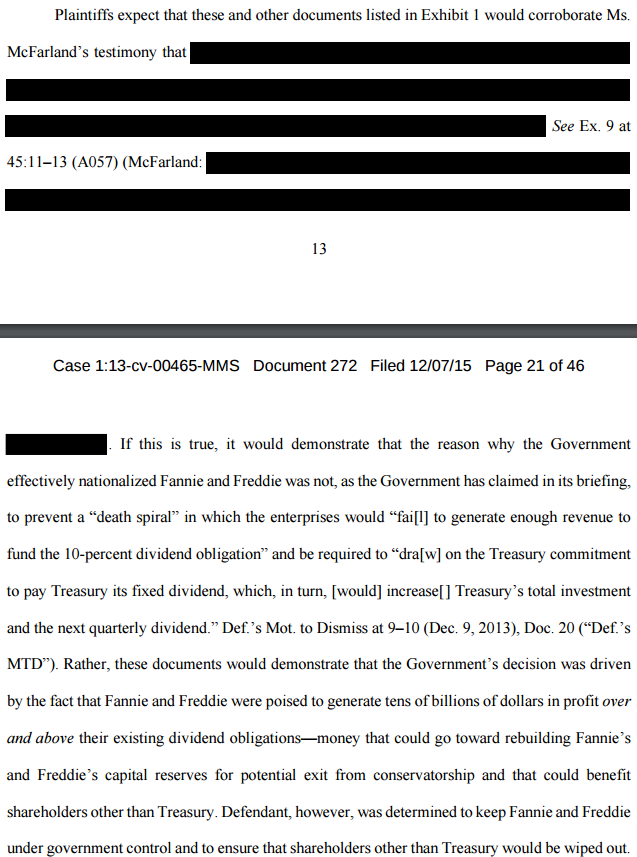

With oral arguments coming up this Friday, the government continues to fight against plaintiffs talking about what's behind redactions in plaintiff's briefs:

It is self-evident that Treasury officials considered dividends in kind. The implication is that Fannie Mae and Freddie Mac were being controlled by the government agency FHFA when they decided to sweep their net worth to the government to avert a cash shortage crisis that didn't actually exist. Further, according to plaintiff interpretations of state law in another suit, the government shouldn't have been able to legally pay themselves dividends at all:

Not surprisingly, plaintiffs want to discuss the facts of what actually happened and have been fought tooth and nail at every turn. At present, FHFA and Treasury are contesting plaintiff motions to allow discussion of discovery documents, included in their merits briefs during oral arguments this Friday:

Judge Sweeney has been allowing discovery materials to propagate under seal to multiple courts including this Appeals Court. This upcoming week could be game changing depending on how Sweeney rules on motions that have been filed under seal by plaintiffs.

Consolidation of Auditor and Other Cases

Further, FHFA and Treasury are now looking to insulate the auditor actions of PricewaterhouseCoopers and Deloitte:

What's ironic here is that plaintiffs are suing for blatant accounting manipulations favoring self-dealing and the government appears on the surface to be assisting in covering it up. Maybe it follows that because FHFA and Treasury can do whatever they want, then by extension, the auditors of Fannie Mae and Freddie Mac can do whatever they want while their actions during conservatorship are also shielded from public scrutiny. Investors Unite's Tim Pagliara, has filed suits to inspect the books of Fannie Mae and Freddie Mac and that has also been an uphill battle.

My preliminary understanding is that the government is looking to consolidate all of these cases to Judge Royce Lamberth, who has ruled in their favor:

Plaintiffs even go as far as to quote FHFA's own arguments against FHFA's efforts to consolidate:

We'll probably learn a lot more about these motions to consolidate sometime between Perry Capital's oral arguments and the subsequent ruling. Look forward to Judge Sweeney's ruling on Fairholme's Motion To Compel in the Court of Claims.

Summary & Conclusion

Because HERA is virtually the same as the FDIA, it would stand to reason that there is an interesting opportunity pairs to trade the GSEs and SIFIs. Personally, I am going long the GSEs. I made a lot of trades since my last article and now own 64590 shares of FNMAJ, 15989 of FMCKI, 9340 shares of FMCCP, 5000 shares of FMCKP, 3500 shares of FMCCT, and 1402 shares of FMCKO. These are preferred securities in Fannie Mae and Freddie Mac with a total par value of $3,144,025 and I have borrowed around $240,000 in order to take this position.

I am expecting a favorable legal outcome sometime this year for plaintiffs. I have set myself up for a binary outcome. Either I am bankrupt and I default on my loans that I borrowed from SIFI institutions or as the former Chief Justice of the Supreme Court of Delaware Myron T. Steele puts it:

Perry Capital court's reasoning is utterly bankrupt, and this Court should repudiate it.

I would own common shares of Fannie Mae and Freddie Mac if FHFA wasn't in charge, and I would probably own the SIFI bank stocks if Fannie Mae and Freddie Mac were never placed into conservatorship. Unfortunately, as a matter of public policy, Fannie Mae and Freddie Mac were used as scapegoats to absolve the real culprits of the mortgage-backed security crisis of 2008. The CFO at the time of the net worth sweep even seems to corroborate the plaintiff's story that the government nationalization was to wipe out non-government shareholders:

Time will tell if conservatorships can be used to wipe out minority stakeholders, at which point, it would seem that I would be applying for jobs at the FDIC as an internal expert of how FHFA did the GSEs in. As the capital buffer at Fannie Mae and Freddie Mac continues to erode per the wind-down plan, it is increasingly interesting that the debt securities that are just beneath the surface trade as highly as they do. If I'm wrong about Fannie Mae and Freddie Mac, then perhaps so too are those that invest in the securities that they issue. The government singling out minorities who do not have a controlling interest to take their economic value is what I'm betting against by owning equity shares of Fannie Mae and Freddie Mac.

Disclosure: I am/we are long FNMAJ, FNMAS, FMCCP, FMCKI, FMCKO, FMCKP, FMCCT, FMCKJ, FMCCH, FNMA, FMCC, FMCKJ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Comments

Post a Comment