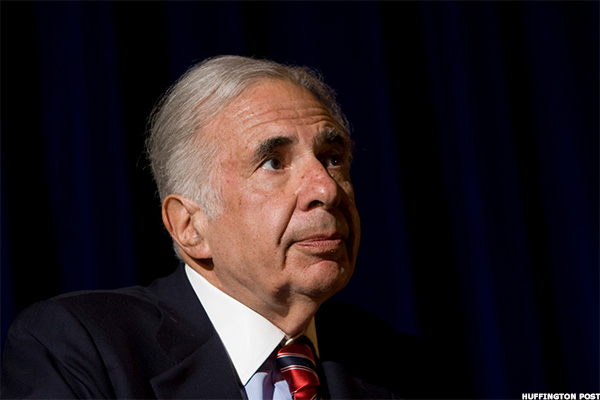

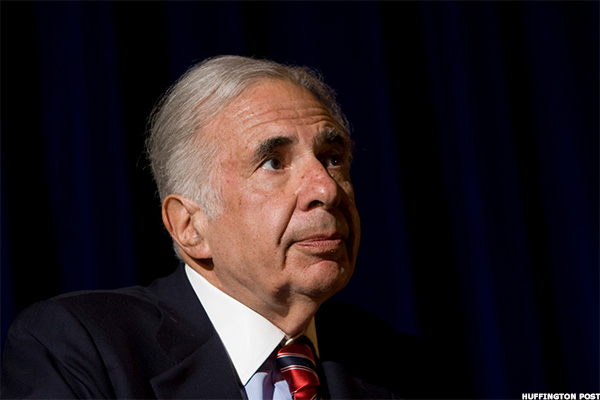

Carl Icahn vs Obama we laliasia.finance are on Carl Icahn

NEW YORK (TheStreet) -- Carl Icahn has become the latest big name investor to wager on shares of Fannie Mae (FNMA_), according to court documents made available Monday.

Icahn purchased 6.828 million shares of Fannie Mae common stock from the Fairholme Fund on March 11 for $4.03. Fannie Mae Shares were up more than 2% to $4.53 in mid-morning trades on Tuesday.

Fairholme is managed by Bruce Berkowitz, a Morningstar manager of the decade and one of the highest profile investors in both common and preferred stock of Fannie Mae and Freddie Mac (FMCC_).

"The de minimis sale of Fannie Mae and Freddie Mac common stock several months ago was previously reported in our 13-F filing. Given the essential role of these companies in supporting American homeownership, our views regarding their value remain unchanged," said Daniel Schmerin, director of investment research at Fairholme, in an emailed statement.

Icahn joins several big name investors including Perry Capital, the Blackstone Group (BX_)and Bill Ackman's Pershing Square Capital Management in the fight to reclaim a share of profits of Fannie and Freddie from the Treasury Department, which currently "sweeps" all the earnings of the government-sponsored enterprises onto its own balance sheet. That situation was made possible in 2012 by the government's conservatorship of the GSEs, which is the subject of litigation involving some of the country's highest profile litigators, including former solicitor general Ted Olson, now with Gibson Dunn & Crutcher. The fight for Fannie and Freddie profits has also created some highly unusual alliances, between Tea Party groups and Ralph Nader, for example.

The Obama administration backed bipartisan legislation aimed at winding down Fannie and Freddie, but the bill that has attracted the most support, known as Johnson Crapo, appears stalled in the Senate after passing the Senate Banking Committee without the support of key Democrats like Elizabeth Warren (D., Mass) and Chuck Schumer (D., N.Y.). That bill broadly endorsed the Obama administration's policy of ignoring private shareholders in the GSEs, though the Democrats who opposed it did so on chiefly on the grounds that it would make it more difficult for low- and middle-income people to buy homes.

The Obama administration backed bipartisan legislation aimed at winding down Fannie and Freddie, but the bill that has attracted the most support, known as Johnson Crapo, appears stalled in the Senate after passing the Senate Banking Committee without the support of key Democrats like Elizabeth Warren (D., Mass) and Chuck Schumer (D., N.Y.). That bill broadly endorsed the Obama administration's policy of ignoring private shareholders in the GSEs, though the Democrats who opposed it did so on chiefly on the grounds that it would make it more difficult for low- and middle-income people to buy homes.

Comments

Post a Comment